How Value-Based Care Contracting Works with Accorded

Get Out-Of-Pocket in your email

Looking to hire the best talent in healthcare? Check out the OOP Talent Collective - where vetted candidates are looking for their next gig. Learn more here or check it out yourself.

Hire from the Out-Of-Pocket talent collective

Hire from the Out-Of-Pocket talent collectiveValue-based contracting: the basics

Healthcare 101 Crash Course

.gif)

Featured Jobs

Finance Associate - Spark Advisors

- Spark Advisors helps seniors enroll in Medicare and understand their benefits by monitoring coverage, figuring out the right benefits, and deal with insurance issues. They're hiring a finance associate.

- firsthand is building technology and services to dramatically change the lives of those with serious mental illness who have fallen through the gaps in the safety net. They are hiring a data engineer to build first of its kind infrastructure to empower their peer-led care team.

- J2 Health brings together best in class data and purpose built software to enable healthcare organizations to optimize provider network performance. They're hiring a data scientist.

Looking for a job in health tech? Check out the other awesome healthcare jobs on the job board + give your preferences to get alerted to new postings.

TL:DR

Accorded combines actuaries and software to make it easier to create value-based contracts for providers. They have a three stage process that helps providers figure out how much they can reduce costs, suggest different value-based care arrangements to payers, and create a space where both can see how the provider is performing.

The goal is to give providers more knowledge and leverage approaching the value-based care negotiating table, but the company will have to navigate their services vs. tech needs, brand name competition, and existentially if value-based care actually gets traction

Also I convinced Accorded to give OOP readers a complimentary actuarial assessment for anyone that wants it. You can get it here.

We also de-identified a real value-based care contract and then walk through pieces of it in the post AND created an actuarial calculator that you can mess with. Yo I put a lot of work into this post lol.

This is a sponsored post - you can read more about my rules/thoughts on sponsored posts here. If you’re interested in having a sponsored post done, email nikhil@outofpocket.health.

Company Name - Accorded

Accorded uses actuaries and software to make it easy for companies to build value-based care contracts. The company used to be called Cerebrae, but to be honest no one knows what the hell a Cerebrae is. I thought it was that machine professor X uses, but apparently that’s Cerebro.

Today the company is called Accorded. Accord means to give power to OR to find consistency, but Accord was obviously too expensive of a URL to buy so they went with the past tense of it. That’s the real value-based contracting.

The company was founded by Frank Cheung and Thomas Bedington and has raised from Stepstone Group, Fika Ventures, Susa Ventures, and Route 66 Ventures.

What pain point does it solve?

There is an ever-constant debate in the world. Which is more painful? Giving birth, getting kicked in the nuts, or creating a value-based care contract with a payer.

Fee-for-service contracting is simple and templatized. The insurance company will tell you the list of services they reimburse for and usually gives you some % of Medicare reimburses. You’re not trying to guess the outcomes of your services or don’t need tons of historical data to get the contract together. So easy, a caveman with a National Provider Identifier could do it.

Now let’s say you want to get paid on patient outcomes. Many times digital health companies will go to a payer and be like “yo my customers took this survey and said they wouldn’t go to the emergency room next time trust me bro. That saves $1500 for every person that said that. So give me $150 per person. Value-based care is simple, chumps.”

But this is not actually how it works. Insurance companies usually want an analysis that is “actuarially sound.” Actuaries run a more rigorous analysis that compares more variables, controls for certain things like population and benchmark spend, and can tell you the future of cost spend. In fact, actuaries can tell you when you’re going to die. Because they’ll explain their job and you’ll die from boredom right there. Just kidding, love my actuary homies.

The actuarial firm is essentially loaning their name/expertise to say “we’ve looked at this and it meets the standards of actuarial excellence.” This makes getting on board with the contract much easier for the payer or employer.

The problem is that:

- It’s expensive to get these actuarial analyses done. They can cost anywhere between $250-$600/hour, and benchmark analysis alone can cost tens of thousands.

- There are lots of spreadsheets and CSVs that float around during the process and lots of “wait there’s no PHI in there right?”

- The payers and providers really should be sharing data to improve the provider operations but just ask your friends in value-based care arrangements how that’s going and learn some new expletives

- Going back and forth on the contracting and agreeing on what it looks like can take 6-24 months.

What if we could make this easier?

What does the company do?

Accorded uses a combination of actuaries and software to create an “actuarial ops” product. In essence, they’re trying to get all the data in one place so that value-based contracting and the actual performance in the contract feed into each other. There are three key components to the product: Opportunity Development, Contract Design, and Performance Evaluation.

Stage 1: Opportunity Development - When you sign up with Accorded they do a customer onboarding call where they help providers identify and size addressable cost of care and how their clinical solution can impact costs. They’ll ask questions about how the care model works, which patients it works for, how expensive those patients typically are, how they use the healthcare system, how the provider would like to get paid, who let the dogs out, etc.

If a company doesn’t know that answer, Accorded has actuaries, software, and 1B+ reference claims from Medicare, MarketScan, claims databases, etc. that can help figure that answer out.

The providers need to use this analysis to prove to payers the size of the opportunity impact for the patients they cover. Accorded did this analysis on the neurocognitive disorder (NCD) patient segment, so we used it to make a lightweight calculator that you can play around with yourself since I know how having a Google sheet in front of you makes you think you’re being productive.

This shows the savings opportunity for managing something like dementia care in Medicare (they've done this analysis with Rippl Care and a company Route 66 Ventures is incubating in this area.) You can see it in the calculator, but if ED visits are reduced by 30% for patients with a neurocognitive disorder (NCD), then you can project that the payer will see:

- 18.2% increase in operating income

- 1.8% reduction in their medical loss ratio (the dollars they must pay out in claims).

Accorded will do these kinds of analyses with companies, and then use that info to help companies set their pricing, milestone payments, custom patient cohorts they want to target, and more. This process gives Accorded a base model with inputs for the company so that when they approach a payer interested in a value-based care contract, they can take the claims data from that payer and see how the company would perform. The base models get updated over time as the company gets more data on how the model performs.

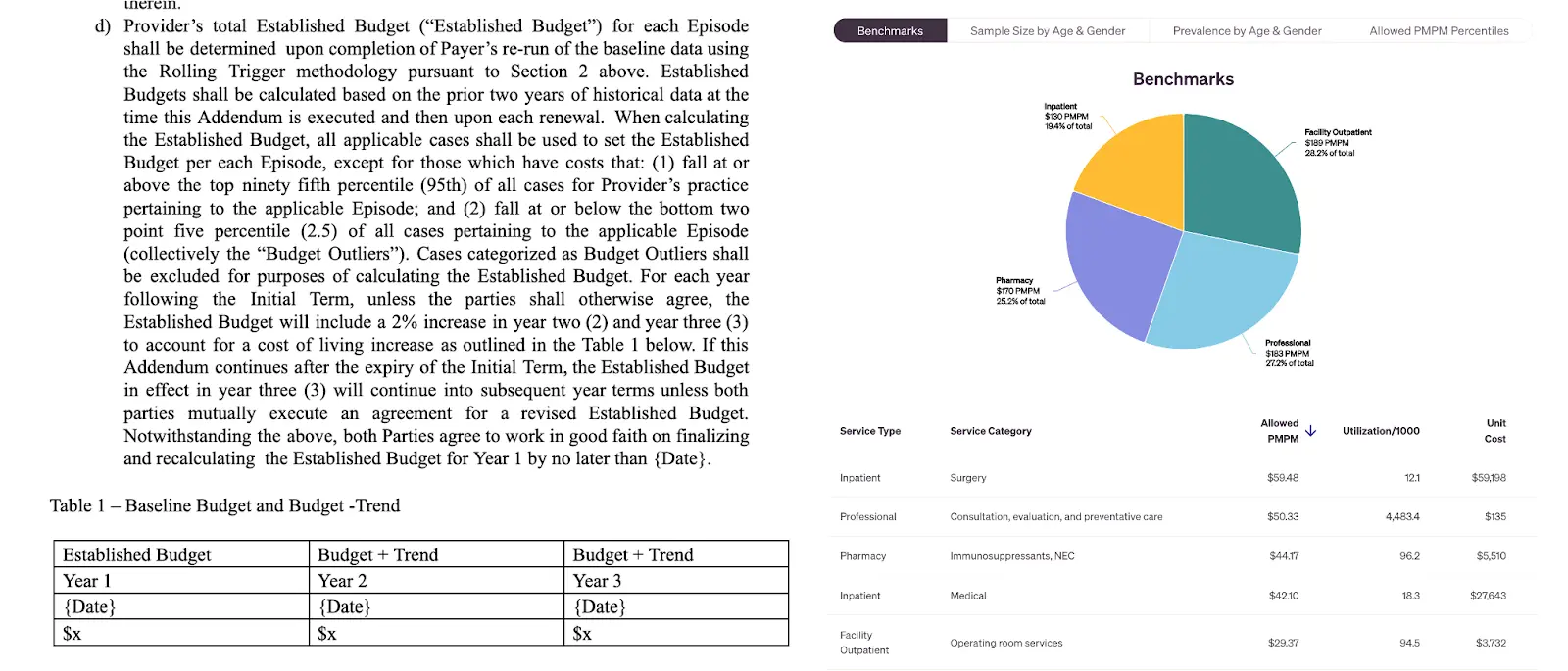

You can create these reports to understand how costs are distributed across the different healthcare services used and different patient types

Stage 2: Contract Design - The real fun begins once you need to create a value-based care contract. If you need a refresher on value-based care and the different levels of risk a provider can take, here’s the explanation post.

To make this more tangible, I actually worked with the team there to de-identify a real value-based care contract! It’s a shared savings contract, which you can see here, and we’ll walk through the stuff Accorded does alongside it.

There are so many components of a value-based care contract, but we’ll just talk about a few.

First - You need to define what services will be covered underneath that contract. Let’s say you want to be paid a bundle of cash for a knee surgery - does that bundle include all the physician services, the facility itself, materials, etc.? Are certain things carved out of the bundle? This is called the “Division of Financial Responsibility” - what are the things the provider is on the hook for and what are the things the payer is still on the hook for?

Accorded lets you set the services included within the bundle.

Second - You need to very clearly say which kinds of patients you’re targeting and how long you’re on the hook for. This is also known as “attribution”, “episode of care”, or “wait what?” depending on who you ask. Accorded lets you set up which patients you’re targeting based on different medical codes, which data source it’s coming from, and the length of time you’re considered on the hook financially.

This includes setting up a benchmark amount that the provider should be compared against. Using the Accorded platform, the payer and provider can mutually agree on the starting benchmark spend and what amounts they should target every subsequent year.

If you want to prove you’re doing “well” in value-based care, you need a comparison point or “benchmark”. Accorded shows both parties the different benchmarks.

Third - you need to define the payment cadence. Are you getting paid per member per month? For a specific episode of care? For the entire population at once? Suspiciously close to your fundraise? And related to that, how much risk are you taking as a provider? If it’s only upside, then the bonuses might be small and we’ll call you extractive in the group chat - if you can take on a penalty, then the upside will be higher.

Accorded takes that base model from Stage 1 and then guides you into different contracts you could potentially enter. Their actuaries take into account each provider’s clinical, business, and operations to propose a few different value-based care contracts. They’ll create the contract and negotiate with the payer’s actuaries + medical economics departments until both parties mutually agree on a contract with minimal fist fights.

Stage 3: Performance Evaluation - Once the contract is agreed to, Accorded creates a space where the providers and payers report the data that they’re getting to see if things are going well. This includes a claims data feed straight into Accorded, patient reports, payment history, engagement data, pharmacy claims, etc. This area acts as the shared source of truth for both parties, which they can see against the contract and the agreed-upon parameters.

As more data comes in, Accorded can use the outcomes and real-world data they’re getting to make iterations to the initial model, alter assumptions, and adjust the contract if needed.

Usually, providers rely on payers to tell them their expected performance in the contracting process. But having their own actuarial analyses + access to the performance data gives them a line of sight into their risk and financial requirements (e.g., money they need to have on hand, boring accounting shit idk).

In essence, you're comparing different levels of “engaged” members that actually use your service and then compare their costs against similar-looking patients that represent the comparison group

Accorded combines all three of these stages and aims to be a one-stop shop for payers and providers that want to enter these contracts by combining their actuaries with software to power the process end-to-end.

What is the business model and who is the end user?

Accorded charges a monthly fee for access to its software platform. Their actuarial services are also bundled into that fee. The cost changes depending on how much rizz you have as well as the number of claims and data feeds taken in for the performance monitoring.

Accorded targets three different customer archetypes with this platform:

Providers and Digital Health Companies - For providers and digital health companies, Accorded can do all the actuarial things we talked about (pricing, demonstrating ROI to the customer, etc.). But it can also allow providers to bring their value-based care contract when talking to payers. If a provider is doing a novel care model, they have a better sense of how they’re engaging the patient and changing their utilization. If it’s truly novel the payer typically doesn’t have an off-the-shelf value-based care contract that would work.

Health Insurance Carriers - The flipside of the coin. Accorded is meant to be a tool that helps actuarial teams be more efficient and more seamlessly contract with providers who want to be in value-based care arrangements by setting up shared spaces to test out different scenarios with internal data, collaborate on the contract with other providers, share data to monitor the performance of existing value-based care contracts and more.

Brokers/Consultants/Employers - Brokers and employers are involved in picking employee health benefits. BOOOO WE SHOULDN’T HAVE THAT SYSTEM but now’s not the time for that rant. Accorded makes it easier for brokers and employers to evaluate different digital health vendors, see how they would reduce the company's medical spend, and set up value-based care contracts with the different vendors. Every digital health company says they’ll save you money, but which ones will put their money where their mouth is?

Job Openings

If you’re interested in what Accorded is building and want to work with them, you should reach out to them at learn@accorded.com

___

Out-Of-Pocket Take

Accorded is tackling a difficult problem, but it seems like the number of companies trying to enter value-based care arrangements is only increasing. If Accorded can get both providers AND payers to agree on using this platform for figuring out value-based care arrangements, it can potentially make this entire process much easier for everyone.

Some of the things I like about Accorded:

Easier value-based care contracts and provider leverage - I think we’d see more value-based care contracts if they were as easy to templatize and customize as fee-for-service contracts. I like Accorded’s dream because it should make getting started with these contracts easier. Both parties can see how changing the terms of the agreement would impact them, tweak whichever variables they want, copy and paste the arrangement from one place to another, etc.

On top of that, it theoretically makes it easier for providers to bring their own forms of value-based care contracts to the table instead of waiting for payers to develop their own. I think this would let many different types of value-based care arrangements flourish and allow for more reimbursement experimentation. I’ve already been seeing lots of ad-hoc value-based care arrangements from different types of providers with “opinionated care models” that don’t fall neatly into CPT codes, as I talked about in the “things I’m watching” post. It feels natural that a company would help make that contracting process easier.

The productization of consultants - It’s been a running commentary in this newsletter that there are too many consultants in healthcare. In my head, consultants represent a bundle of things - a brand name giving a stamp of approval for some action, the leadership team getting some “cover your ass” protection for a decision, providing benchmarking to know whether what you’re doing is within normal bounds, running analyses using templates for other clients that have asked for similar things, implementation of a service or vendor, advice, etc.

Some of these things require a lot of people to do. But I think a certain slice of services consultants offer could be productized and encoded in software. Accorded is testing whether the expertise and models of actuaries and value-based care consultants can be turned into software.

Data Collaboration - Sharing data feeds between parties in a value-based care arrangement still seems like a nightmare. I think this is the number one complaint I’ve heard from companies in value-based care arrangements - the payer simply doesn’t share data back to them. The providers need that data to figure out how things are going and if they're going to be paid, or if they need to change things up.

Hopefully Accorded makes this easy enough to set up and makes it a standard for value-based arrangements.

—

I like what Accorded is doing, but like any company, I think there will be challenges ahead.

The need for a human vs. software - One open question with Accorded is how much of this is actually technology that can be built vs. still requires a human in the loop. Is this a tech company, or a tech-enabled consulting business? That sentence just sent a shiver down 1000 startups spines.

Right now Accorded uses a lot of human capital to get customers set up, do analyses, build models, etc. As they get more providers and payers on either side of the platform, then there should be more reusable models and less need for their consultants to come in. The true goal is for payers to agree that the outputs of the platform represent actuarial soundness without an actuary coming in and doing a separate analysis.

Competition and in-housing - As I said above, one of the reasons people get consultants is for these more intangible things like a stamp of approval from a universally accepted firm. Right now Accorded is competing with firms that have a history understood by payers and providers alike, but that brand name comes with a price.

Accorded has to prove that its product is good enough to get that same level of brand recognition. Actuarial analysis is as much art as it is science (which actuaries won’t stop fucking saying), so the payers will always nitpick the assumptions made for things like ROI analyses. The hope is that the platform at least makes it easy for both parties to fidget with the inputs and assumptions until they can agree.

Companies hiring in-house actuaries for these analyses and adjustments is the other competition vector. Accorded views itself as a tool for these actuaries to use and make themselves more efficient so they don’t need to hire actuaries linearly with the company as it scales. But they have to convince those in-house actuaries that that’s true.

The existential question of value-based care - We’ve been attempting the value-based care experiment now for 15 years, and while there's been progress it’s relatively slow. The question is whether it’s slow because the tooling, infrastructure, and experience to execute is bad. Or because there’s an unwillingness from the large stakeholders to take part.

Accorded is starting with smaller stakeholders who are more willing to take on risk from the outset to differentiate themselves from other vendors. But that would limit them to a much smaller market. If creating these contracts were easier, would more providers enter value-based care arrangements?

Conclusion + a few notes

Accorded is tackling a lot, and they know that. But the reality is that value-based care contracts are operationally complex, and maybe they don’t need to be.

The complexity and expense of contracting shouldn’t be the reason that providers avoid value-based care. I think a tool that can simplify the whole process is a positive for the ecosystem.

OOP readers get a complimentary actuarial assessment for anyone who wants it. You can get it here and see if they're legit yourself.

Thinkboi out,

Nikhil AKA. FSA MAAA BAA TSA PRECHECK

Twitter: @nikillinit

Other posts: outofpocket.health/posts

{{sub-form}}

---

If you’re enjoying the newsletter, do me a solid and shoot this over to a friend or healthcare slack channel and tell them to sign up. The line between unemployment and founder of a startup is traction and whether your parents believe you have a job.