Things I’m watching in healthcare 2023

Get Out-Of-Pocket in your email

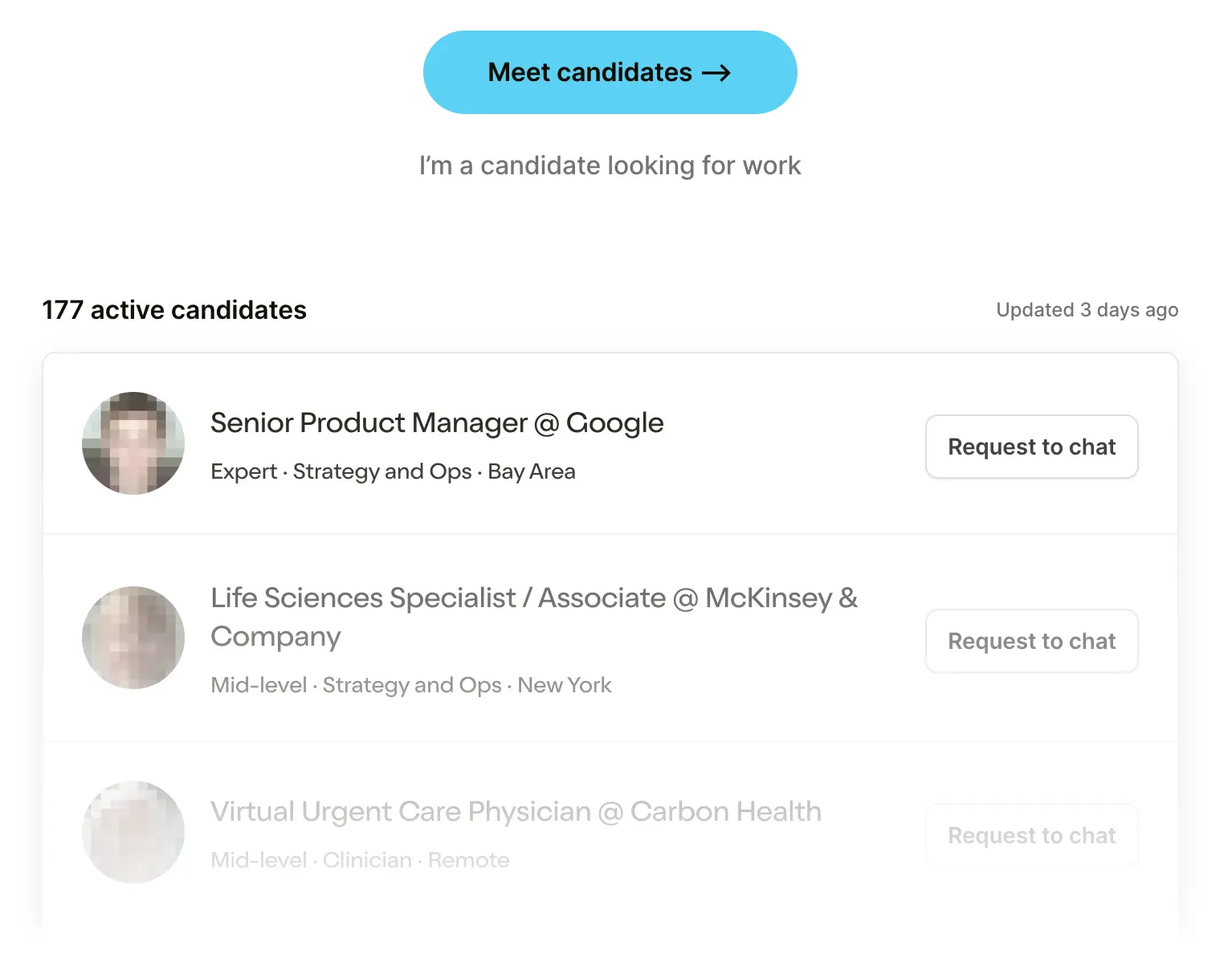

Looking to hire the best talent in healthcare? Check out the OOP Talent Collective - where vetted candidates are looking for their next gig. Learn more here or check it out yourself.

Hire from the Out-Of-Pocket talent collective

Hire from the Out-Of-Pocket talent collectiveValue-based contracting: the basics

Healthcare Product 201

.gif)

Featured Jobs

Finance Associate - Spark Advisors

- Spark Advisors helps seniors enroll in Medicare and understand their benefits by monitoring coverage, figuring out the right benefits, and deal with insurance issues. They're hiring a finance associate.

- firsthand is building technology and services to dramatically change the lives of those with serious mental illness who have fallen through the gaps in the safety net. They are hiring a data engineer to build first of its kind infrastructure to empower their peer-led care team.

- J2 Health brings together best in class data and purpose built software to enable healthcare organizations to optimize provider network performance. They're hiring a data scientist.

Looking for a job in health tech? Check out the other awesome healthcare jobs on the job board + give your preferences to get alerted to new postings.

"What're you seeing dude"

One of these days, someone is going to ask me about my favorite saga in Dragon Ball Z and why (Cell saga). But until then, I’m the “healthcare guy” so people ask me way more boring questions like “what insurance should I sign up for?”, “why can’t I easily schedule an appointment with a doctor”(x5), and always… “what am I seeing in the ecosystem?" as if I can answer that in the last 5 minutes of our Zoom call. So I put together a deck about what I'm seeing and had a conversation with Morgan Cheatham (Bessemer) and Lauren Devos (First Round Capital) about stuff they’re seeing too.

You can get the slides and recordings here, but I wanted to elaborate on the points in this post. Feel free to take these opinions and pass them off as your own, I know you’re doing it anyway.

*indicate companies I’m an investor/advisor to.

Macro stuff

At a high level, we have to acknowledge it’s a little gloomy out there in startup land. Funding and deals have slowed down significantly, especially mega deals. Point solutions are getting rolled up as they struggle to raise. We’re seeing layoffs and shutdowns across the board. The somehow weekly healthcare happy hours are more like ambivalent hours.

As a response to this I’ve seen a few things:

- More companies are starting without VC funding and quickly optimizing for cash/profitability. A lot of new financing options seem to be popping up to help healthcare companies grow and they’re tied closer to revenue. Many founders have never seen the sign-in portal for their accounting software and are going through the forgot password flow.

- From an employee standpoint, I find that many people I know are optimizing for cash over equity in their next gig. They've been burned by their equity being worthless and potential recession fears mean they want money in the bank now. This is particularly bad for the startup ecosystem which generally can’t compete with cash offers of larger companies. This is particularly good for me who no longer has to lie to friends that I know how equity works because I just assumed their startups would die before this mattered and we wouldn’t be friends by that point.

- Customer concentration risk and the quality of the sales pipeline are becoming much more exposed. Some of those “initiated conversation” parts of the funnels were using that phrase real fucking liberally. We’ve seen customer concentration issues in public companies (GoodRx - Kroger, Accolade - Comcast, etc.). This can be an even bigger issue in private companies if you’re not a “must have” vendor AND your customer target pipeline is all in cost-cutting mode.

- Companies are shedding their services components. 98point6 sold its virtual primary care business, Elemy winded down its direct care business, Babylon sold its Independent Physician Association, and many others have quietly laid off services teams while saying “the responsibility lies with leadership” who largely keep their jobs. Most are doing this to reach profitability, but I think others are discovering how many internal processes break down when you scale services across states too quickly. This ends up adding a ton of “ops debt” which is more expensive than most teams realize.

- My ex-consulting friends have decided climate tech is actually the “mission-oriented” place they want to be now.

The other macro changes are on the regulatory front.

- More data is becoming available through the new interoperability rules, price transparency rules, etc. I’m sure hospitals and payers will be super compliant on the dates they’re supposed to go live and will definitely not do super shady things like the respectable businesses they’re known to be.

- The public health emergency ending comes with a ton of downstream effects including Medicaid members now needing to be re-enrolled or enter the individual exchanges, certain bonus payments to hospitals are ending, lots of changes for remote patient monitoring reimbursement, and more. Now the only public health emergency is your face.

- Crackdown on patient privacy, pixel tracking, HIPAA violations, and more. Did you know you can get class-action lawsuits ads on Instagram? Do they understand irony?

- More scrutiny into the middle layers of healthcare. The Consolidated Appropriations Act puts more transparency to broker compensation and prevents health plans from entering agreements that prevent them from withholding cost, quality, and claims data from employers. The FTC is further inquiring into PBMs. Once again, everyone pretends they aren’t a middle layer.

Now onto the more startup-y stuff that I’m seeing.

AI AI AI okay we get it

I’ve seen a lot of pitches or products that use generative AI in some capacity. I started playing a game where I take a sip of water every time I hear "we're at an inflection point" and I've never been more hydrated in my life.

I see a few common buckets generative AI companies are tackling.

The first is “we are making X back-office task much more streamlined and faster”. Common ones include prior authorizations, revenue cycle management, etc. These applications seem promising, but candidly it’s unclear to me how any of them differentiate and it seems like these use cases would actually favor incumbents that already have distribution vs new companies. Why get a totally new startup vendor vs. the existing prior auth vendor you use and trust? Many of these companies feel like they were created in an Adderall-fueled weekend hackathon, which works against them because large companies can also spin them up quickly.

It’s also not super clear to me how this solves the underlying problem of “the counterparty will make that back-office problem hard no matter what”. If you’re making prior authorizations easier for a provider, won’t the payer find new ways to make it difficult again? This seems like an incentive problem more than a tech problem.

The second generative AI bucket is “we’re building a better search interface for X”. Usually this has to do with internal data from different sources being messy to query or complex online searches that need to be chained (5 different UpToDate searches + literature scanning). Generative AI companies still have real problems with totally making things up, which prevents companies from considering them a “must-have”. At the moment, they seem like user interface improvements for an existing product vs. a standalone new company.

The third generative AI bucket is “we’ll create content/coaches to help patients”. This might be creating care plans for patients, guided coaches to help with exercises, etc. Unfortunately these things are largely not revenue accretive aka. you can’t bill for them, so it’s still unclear to me if they’re standalone businesses either. I do think in the near future, we’ll see companies build entirely new care models where AI is a centerpiece (companies like Curai seem to be moving in this direction).

The final bucket is “we help patients do X, Y, Z” with AI. This might be reading their hospital bill, analyzing their explanation of benefits, making appointments via phone calls, etc. I’m actually the most optimistic about this bucket because even at 80% accuracy it helps patients overcome the massive information asymmetry they experience in healthcare and helps them fight against a system that assumes they’re unwilling to fight bureaucracy. That being said, I have no idea what a sustainable business model is for these companies since patients are generally pretty unwilling to pay out-of-pocket.

Some areas I am looking deeper into on the AI side and find exciting though they aren’t all around generative AI:

- Data for AI tuning - More companies are going to need easily accessible and labeled data to train their AI models with healthcare-specific data to get outputs that are more accurate. On top of that, companies with valuable data are trying to figure out how to pre-process and commercialize what they have. Gradient* is doing some stuff here in annotated medical images for example.

- AI video analysis - Video is one of the areas I think AI might be particularly good because it requires humans watching it to be super attentive for long periods of time. They generally aren’t as good at that nor want to spend the time doing it. Virgo* for example does this analysis with endoscopy video footage and Theator analyzes surgical video footage from the operating room.

- Compliance tech - AI-enabled diagnostic tools, clinical decision support, medical devices, etc.- requires a new regulatory framework since software updates are constantly made. The outputs are also naturally more varied since the AI component tries to personalize the situation. The FDA seems to acknowledge this. In working papers around regulating Software-as-a-Medical-Device (SaMD) and post-mortems of the Pre-Certification program they talk about approving “processes” for building and monitoring instead of the specific outcome. That means companies will need to demonstrate to the regulatory bodies that they’re sticking to those processes, which companies like Ultralight Labs* are doing for medical devices.

- Zoom deepfakes that let you leave a meeting in the middle but a replica stays and acts like you’re still there and just says “that’s interesting, can you unpack that a bit” in response to anything - Uh, looking into this for a friend. Many, many friends.

Rural health needs new care models

I don’t think it’ll be news to anyone reading that rural healthcare is struggling. Even I know that and the most rural I’ve lived in is Bushwick.

Rural hospitals don’t have large endowments to generate investment income, struggle to get clinicians to work there and have to pay much higher staffing costs, have patients who are disproportionately on lower reimbursing government plans (e.g. Medicare/Medicaid) or uninsured, etc. They basically have like 2 underpaid residents and nurses that keep the place from collapsing.

Emergency funding during COVID is now drying up and we’re starting to see rural hospital closures pick up once again. This causes a spiraling effect with patients not going to the hospital because it’s far and inconvenient, which slows the volume to the hospital and causes it to close making the next nearest hospital even further.

I’m starting to see new care models and tech-enabled services companies pop-up to address this issue. Some companies like Hippo are providing hardware to better enable telemedicine consults from specialists to various frontline staff in rural areas. Main Street Health combines a health navigator, data tools, and value-based contracting expertise to work with rural health providers.

I’m particularly interested in micro-hospitals for rural areas, which I’ve seen different flavors of. Bringing hospital-level care to the home setting (aka. hospital-at-home) was tried en masse during COVID thanks to some waivers that allowed for it. I think the data will end up showing it worked well. If it doesn’t I’ll delete this post and pretend I always had the opposite stance.

In tandem, there’s a new federal program to give huge $$ boosts to hospitals that convert into Rural Emergency Hospitals.

“Hospitals that convert into the new federal Rural Emergency Hospital designation will get a 5% increase in Medicare payments and an average annual facility fee payment of about $3.2 million in exchange for giving up inpatient beds and focusing solely on emergency and outpatient care.” - KFF Health News

Maybe small-footprint hospitals could get started in rural areas that use hospital-at-home level care to replace inpatient recovery and lean into this designation. I’ve seen some people floating around this idea.

Biosecurity

A few things happened in the last decade.

First, I went through puberty and it was an all-around awkward time. I picked up humor as a defense mechanism.

Second, the US outsourced massive parts of the pharma supply chain overseas. A lot of the production of active pharmaceutical ingredients (API) has been in China and India does a lot of the generic manufacturing. Most of the generic drug ingredients like atorvastatin could pass as South Indian last names, so it’s a good fit.

Third, a lot of new drugs are biologics or gene/cell therapies that are much more difficult to manufacture because they involve creating living organisms. This creates a lot more batch-to-batch variability - in the cases of gene/cell therapies, they're made specifically per patient with no room for error.

There’s now been a big push for biomanufacturing in the US for quality, supply chain resilience, and security reasons. For example, hospitals banded together to create CivicaRx in response to drug shortages and price inflation of basic medications and are now manufacturing insulin for California. And we’ve also seen more Contract Development Manufacturing Organizations (CDMOs) that specialize in different types of biomanufacturing like Resilience and VintaBio as well as new software companies to help with the logistics and quality assurance these manufacturers might need creating therapeutics.

Finally, COVID made it very clear that our healthcare system was a vulnerable vector of attack. I don’t think I need to explain this to you. Now AI papers are coming out suggesting drug discovery algorithms can be used to create new bioweapons. Yet they still can’t tell why kids love the taste of Cinnamon Toast Crunch?

It seems like different parts of the healthcare system might be a more persistent threat to national security.

There’s a more targeted national effort in how this relates to domestic security that will create new company opportunities. The DoD released a biomanufacturing strategy that strongly pushes to do more domestically. And I’m sure as public health dollars start dwindling post-COVID, we’ll start seeing companies initially being used to monitor COVID outbreaks start eyeing some of these biosurveillance and biosecurity initiatives that are likely much more lucrative.

Decoding Bio put out a market map around this idea recently. I know you lazy fucks love a bunch of logos in squares, so enjoy.

Opinionated care models

There seem to be increasingly more companies that are taking a “stance” in their care model. In a traditional visit, you see the doctor, and based on what they know about you they'll recommend a treatment pathway. A new crop of companies is instead identifying the target patient profile first and reaching out to patients saying “we have this treatment plan that we think is good for you”.

Some examples of opinionated care models:

- Medication-first companies where a certain drug modality is at the core of the treatment plan (e.g. ketamine, GLP-1s, etc.). And when they go a little too far, they can expand into…

- Deprescribing as a care model where companies do a program to reduce the amount of pharmaceutical products a patient uses. Virta is using ketogenic diets to move off diabetes medications, Outro is helping healthily wean off of antidepressants, Menda uses pain reprocessing therapy boot camps to reduce reliance on pain medication, etc. This has become an area of interest, especially as health insurers and employers see their pharmacy spend spiking.

- Care team permutations where a care plan is heavily dependent on utilizing a specific type of person in their clinical team like a coach, peer with the same disease, eastern medicine practitioner, a vet if you got that dog in you, etc.

- Screening-based companies where the underlying belief is “we should be screening everyone” and use MRIs, lab tests, etc. more regularly. I wrote about why we don’t do this but I'm not close-minded that they might help.

I’m not saying I love all of these companies, just relaying what I’m seeing. Most of these care models will be relatively polarizing; that’s the byproduct of having any strong opinion.

Because they’re polarizing and usually not practicing within traditional evidence-based guidelines, many of them frequently can’t bill traditional fee-for-service and either need to jump straight to some outcomes-based reimbursement or go for cash-paying patients. My open question is whether these companies can become large enough to support a venture-scale outcome or are limited because of reimbursement issues and narrow target patient populations.

Contracting and payment rails

I guess the thought pieces are finally working.

More companies are trying to make the contracting and payment process easier. Employers want to more easily set up contracts with vendors, payers and providers are getting more complicated with contracting, providers that are taking on financial risk want to more easily create subcontracts with vendors they use, etc. Lawyers meanwhile are wondering which boat they’re gonna buy with these fees.

A bunch of new companies are popping up to use data that power new contracting software. Accorded uses actuarial data to show potential cost savings that lead to creating value-based care contracting. Turquoise uses new price transparency data to power their contracting platform for payers-providers. CCX seems to use data about disease prevalence, drug pipelines, and real-world data to make it easier for pharma to get paid on outcomes or other more complicated agreements.

Contracting isn’t just within healthcare, but now interfaces with the regular world as well. This is especially true in areas like Medicare Advantage where health plans need to pay home improvement vendors, food vendors, etc. that fall under supplemental benefits. Companies are popping up to not only create default contracts and payment rails, but also making sure that vendors and people getting paid are falling under compliance with the health plan rules.

The collapse of small business insurance

Small group insurance seems like it’s in a tough place. Large insurance carriers like Humana are exiting the market entirely in favor of government plans and small groups are seeing their premiums jump 20%+.

This is resulting in two things. Small groups are starting to see options like ICHRAs as a way to effectively push some of that cost and unpredictability to employees. They give employees a defined tax-exempt amount of money to shop for health insurance on their local exchanges. Several companies like Take Command, Venteur, Lunchbox, Thatch and more are making in-roads here.

And new plans like Arlo and Curative target businesses with few employees and offer new level-funded plans. These are businesses that typically have been too small to be self-funded where they pay all of their employees medical themselves - one really sick employee would bankrupt the business. But level-funding provides a stepping stone where you take on more of the employee's financial risk but have some measures to prevent catastrophic bills from destroying the business.

Conclusion

Morgan and Lauren had some great thoughts on how AI startups can stand out, things that have changed in the diligence process, and more which you can check out in the recording. I mostly just sat there being sweaty and worrying if people could see the state of my living room behind me.

Let me know what you’ve been "seeing in the ecosystem".

Thinkboi out,

Nikhil aka. “Eye Of Moron (pronounced like Sauron)"

Twitter: @nikillinit

Other posts: outofpocket.health/posts

Thanks to Morgan Cheatham and Jay Rughani for reading drafts of this

P.S. Knowledgefest applications close tomorrow. It's a tactics-focused conference just for people who are around healthcare operations. Learn more and apply here

{{sub-form}}

---

If you’re enjoying the newsletter, do me a solid and shoot this over to a friend or healthcare slack channel and tell them to sign up. The line between unemployment and founder of a startup is traction and whether your parents believe you have a job.