Pharmacies Inside-and-Out With John Capecelatro

Get Out-Of-Pocket in your email

Looking to hire the best talent in healthcare? Check out the OOP Talent Collective - where vetted candidates are looking for their next gig. Learn more here or check it out yourself.

Hire from the Out-Of-Pocket talent collective

Hire from the Out-Of-Pocket talent collectiveHealthcare 101 Crash Course

%2520(1).gif)

Featured Jobs

Finance Associate - Spark Advisors

- Spark Advisors helps seniors enroll in Medicare and understand their benefits by monitoring coverage, figuring out the right benefits, and deal with insurance issues. They're hiring a finance associate.

- firsthand is building technology and services to dramatically change the lives of those with serious mental illness who have fallen through the gaps in the safety net. They are hiring a data engineer to build first of its kind infrastructure to empower their peer-led care team.

- J2 Health brings together best in class data and purpose built software to enable healthcare organizations to optimize provider network performance. They're hiring a data scientist.

Looking for a job in health tech? Check out the other awesome healthcare jobs on the job board + give your preferences to get alerted to new postings.

In light of the news that Amazon Pharmacy is launching thanks to their acquisition of PillPack, I thought I’d publish this interview which taught me a lot about how pharmacies work. Today I’m interviewing John Capecelatro, early employee at PillPack about everything related to pharmacies.

We discuss:

- The different kinds of pharmacies/contracts and issues with them

- Misaligned incentives

- How pharmacies think about and address the needs of different types of patients

- PBMs

- Pharmacy licensure

- The role of the pharmacist

- and more.

1) What's your background, current role, and the latest cool healthcare project you worked on?

I grew up in upstate NY (Utica, not Westchester County where most think upstate NY is). My interest in healthcare/tech was fueled by 1. managing Crohn's Disease for ~20 years and having a deep empathy for the patient journey, and 2. having zero desire to work in finance or consulting like many of my college classmates.

The last cool healthcare project I worked on was my 5 year stint at PillPack. I began my career at the then-small pharmacy startup as a software engineer. The company had just raised its seed round led by Founder Collective, and was 12 employees. And although I had studied 'business' in college, I had also taught myself to program and was interested in understanding how 'tech' was actually built, so I joined the company initially as a software engineer. PillPack had this unique challenge of being an operationally-intense business that used tech as a lever to scale (versus Silicon Valley's darling SaaS model). So many of the problems we were solving were about how we could use software to scale these wildly complex processes in the pharmacies we operated. Over the course of the proceeding 5 years, I worked across engineering, analytics, and operations to help rapidly scale the company. Amazon acquired PillPack in the fall of 2018.

Currently I’m the Director of Operations at Nava, a new benefits brokerage tackling the weird world of health benefits.

2) What was one of the most unexpected challenges of starting a mail-order pharmacy from the ground up that you were surprised by?

I think in hindsight many of these challenges are obvious, but they certainly didn't feel that way at the time. The two that come to mind are: 1. navigating the regulatory-complex pharmacy landscape, and 2. managing the unit economic cost of building and scaling the pharmacy business.

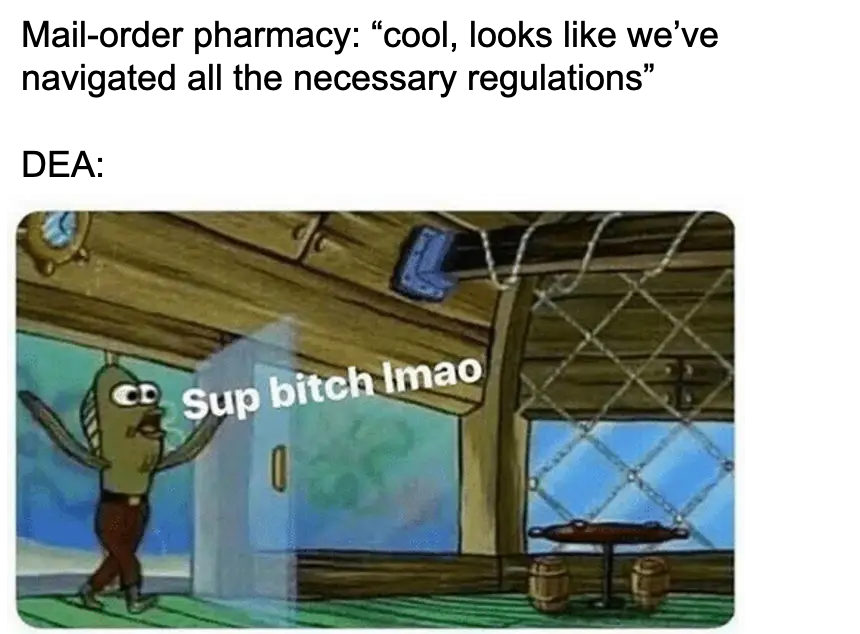

As for 1., pharmacies of all flavors (long-term care, mail order, and retail) are regulated at both the state (by pharmacy boards) and the federal (by the Drug Enforcement Agency (DEA)) level. In order to ship medication to a given state, the pharmacy, pharmacist-in-charge (PIC), pharmacists, and occasionally the pharmacy technicians need to be licensed both in the originating state (i.e. where you're sending the shipment from) and the destination state (i.e. where the shipment is going). Obtaining and maintaining multiple levels of licensure is a complicated and time-intensive process -- one that requires constant attention to detail and patience -- as often, you as the pharmacy have very little control over how long this process takes. Some states turn licenses around in a week, others take years. And even if you do everything right, you can find yourself surprised by Rumsfeld-ian 'unknown unknowns', like DEA HIDTA zones that add additional constraints around pharmacy licensure. Layer the above on top of a desire to scale rapidly, and you have just an extremely difficult regulatory process to manage.

As for 2., running any pharmacy (long-term, mail order, and retail) is expensive. Your COGS stack consists of labor (a portion of which -- the pharmacist -- is quite expensive), and drug costs (of which you can only partially control). And as a mail-order pharmacy, you also have to add shipping (i.e. your postage cost) and packaging (i.e. the boxes and associated material used to package the medication). When you sit down to add each of these discrete categories up, you start to realize that the unit economics of the model look very different than what most folks in startup land are used to seeing. In order to manage these costs, it was critically important for us to first measure and then track each over time. Once you have clarity on each of these levers, you can begin to plan for process improvements (whether human or tech-driven) that can drive positive margin over time.

3) I'm sure you've seen plenty, but what's a misaligned incentive in the pharmacy world that you ran into?

There are indeed many -- the entire ecosystem is one giant misaligned incentive. But one in specific sticks out to me, and that would be the presence of prior authorizations. Fondly known as PAs in the biz, these requirements by various insurance companies stipulate that an individual must receive authorization for a given therapy (drug or otherwise) by their provider. It's the insurance companies' attempt to control costs for more expensive medications or procedures, but in practice, it tends to be a major roadblock for individuals, and a massive coordination headache for all involved. Most individuals don't have a clear understanding of how, when or why PAs exist. Many providers have a similar lack of clarity, and most don't have a great process for actually submitting the PA to the insurance company for approval. And lastly, the insurance companies don't communicate clearly with individuals and providers about when PAs are necessary, and often take too long to approve them. The end result is a shit experience for the individual -- one that could also be quite expensive to deal with (if a medication is given to an individual without a PA on file, the individual could be liable for the full cash price of the medication, instead of the insurance-reimbursable amount).

4) Why is it hard for a mail-order pharmacy to go into retail, or vice versa? Surely it can't be THAT hard once you have the fulfillment operation down? :)

Sure - they're all 'structurally' pharmacies, but each have very different operating models. More specifically, there are three key differences that come to mind:

1. PBM Contracting - each 'type' of pharmacy (long-term care (LTC), mail-order, and retail) have different, standard contracts with pharmacy benefit managers (PBMs). Much ink has been spilled on the dubious role PBMs play in the industry, but for simplicity's sake, each of these pharmacy models receive different reimbursement rates from PBMs. Typically, LTC rates are the highest, followed by mail order, then retail. This means that the revenue and margin characteristics are favorable in LTC then become progressively worse until you get to retail. Related, LTC and mail order contracts allow for 90 day (or longer for LTC) fills whereas retail is usually only for 30 day fills. The cascading effect of these reimbursements means that each pharmacy model has different financial constraints to operate within, which leads me to the next point.

2. Capital Requirements - Depending on the PBM contracts of the model, the pharmacy will have more or less ability to actually fund its ongoing operations -- either with the margin baked into the contract or some other funding source (e.g. debt or equity). In most contexts, retail pharmacies will need to operate brick and mortar storefronts -- an additional cost (i.e. rent, insurance etc.) that comes with operating this type of pharmacy (and often why it's extremely rare to find a physical pharmacy that doesn't also sell convenience store items). While mail-order pharmacies don't operate storefronts, they operate warehouses and have to pay for additional postage and packaging in order to deliver meds. And long-term care pharmacies may operate within a single facility or a small chain of facilities (and have a correspondingly cheap operating model); the downside for these pharmacies is the pool of 'customers' served is based on the capacity of the facility or facilities. So in short - while each pharmacy model acquires and dispenses medication to customers, the underlying mechanics of each model are quite different and have corresponding costs and complexities -- each of which are difficult to individually manage based on the above contracting weirdness. And to manage multiple models at the same time feels...very tough. I could see this happening if there were an umbrella holding company & each 'division' was operating its own P&L and there was a shared-services model that reduced some ongoing OpEx or R&D costs.

3. Operational Complexity - And lastly, each operating model has its own idiosyncrasies. As mentioned above, only mail-order pharmacies need to carry the additional cost for packaging and shipping medication. Only retail pharmacies need to develop and fund a 'real estate' function for operating storefronts. Only long-term care pharmacies will contract with long-term care facilities, often operating within a facility as a pharmacy. These are just examples of many processes and costs that are unique to each model -- processes and costs that are tough enough to scale for a single model, let alone two or three in parallel.

5) What are the different types of patient segments you have to think about at PillPack? Can you talk through the problems you face in one or two of those segments?

Two segments that I remember being particularly difficult to serve were:

1. elderly individuals - This population is often managing one or more chronic conditions, meaning they are receiving several medications over the course of the month. These medications are often managed by multiple providers -- each with their own idiosyncrasies around managing prescriptions (i.e. refills, generic / therapeutic alternatives, prior authorizations, appointment requirements) -- across one or more insurance plans (e.g. Medicare Part D, private/supplemental insurance). Layer all of this complexity on top of this population using more operationally-intensive communication channels (e.g. phone, physical letter) and you have a large cohort that mandates a very different service experience than other cohorts. The biggest service issues we encountered were around managing payment for medications (e.g. many wanted to pay by physical check, others didn't understand the 'donut hole' effect - side note, who really understands that?), and the logistical complexity to ensure every one of these patients' medications were sent on the according schedule. And what's important to call out here is this population is increasing in size as this country continues to age. So the necessity to design and scale a service that suits this population continues to grow proportionally.

2. individuals managing an acute medical event - This population may only be managing one or two medications at a time, but they often are extremely time sensitive. A common example is an individual may be prescribed a Z-Pak for an infection or a cream for a rash. These medications are often needed the same day, if not within a small handful of hours. As a mail-order pharmacy, it was -- and still is -- difficult to address the turnaround times (e.g. 12 hours) necessary to receive, process, and ship the prescription. I expect as the service continues to scale, there will be opportunities to provide a much quicker turnaround than the typical 2-3 day shipping time for most medications.

6) What's the role of the pharmacist in all this? Is that role different between a mail-order vs. a pharmacist we might see at CVS/Walgreens?

The role of the pharmacist is broadly the same in all three major settings -- long-term care, mail-order, and retail -- with some key differences. Regardless of the type of pharmacy, pharmacists are reviewing prescriptions for accuracy, approving disbursement of medication, consulting customers on questions regarding their medications (e.g. medication therapy management), involved in compliance-related matters (e.g. prescription drug monitoring programs), and training staff. That said, mail-order pharmacists have a few additional nuances around managing and reviewing disbursement of medication. At PillPack, for instance, pharmacists are reviewing photographs of every individual packet of medication to verify its contents against the expected order, and performing a similar review on the contents of the entire shipment (if, for example, it contains a medication that comes in a bottle or tube, versus a collection of packets). Lastly - the communication channels for consultations with customers are different in retail vs mail-order -- in the former, you can see your pharmacist in person, while in the latter, you'll just be chatting on the phone.

7) I've heard getting a pharmacy license in a state is pretty difficult - what does that process look like/is there a lot of variation between states?

Obtaining the license in each state -- whether resident or non-resident -- is not particularly difficult, just time-consuming. The process typically involves reviewing a state's application process (e.g. New York's) to verify qualifications (e.g. the appropriate schooling has been completed) -- there's not much variation in each state), submitting the application and fee. Some states may require fingerprinting or an interview process with the state's board of pharmacy (for the pharmacy entity in most cases, not the individual). The difficulty in this process lies in managing the nuances of state-specific requirements around dispensing rules and continuing education requirements. Individual states may have rules around what schedule a drug is and how that drug can be dispensed (e.g. by a certified pharmacy technician only, for a certain number of days only etc.). Similarly, individual states may have different rules around how pharmacists must participate in educational programs (e.g. 2 day course on controlled substances) to maintain their licenses. Staying abreast of these changes and adjusting operations accordingly is challenging.

8) Are PBMs actually useful today? Do you think there's a way they could be more useful than they are now?

Broadly, no. Pharmacy benefit managers have long taken advantage of an opaque market, and ultimately of a vast swath of the population. They mostly exist to extract - not provide - value in an efficient and complex supply chain. As for how they might become more useful, I think there's an opportunity to provide a better consumer shopping experience for prescription medications -- starting with pricing transparency, therapy education, and access. A forward-thinking, independent PBM (most of the major PBMs are not quite independent and are instead tightly intertwined with the major payers) could build a version of this.

Bonus: As a purveyor of meat smoking, is the green egg worth it?

Ha - for pure smoking, nah. I'd go with the Weber Smokey Mountain instead (more info on my smoke log).

Thinkboi out,

Nikhil aka. “the target audience for these millennial branded pharmacy startups”

Twitter: @nikillinit

Healthcare 101 Starts soon!

See All Courses →Our crash course teaches the basics of US healthcare in a simple to understand and fun way. Understand who the different stakeholders are, how money flows, and trends shaping the industry.Each day we’ll tackle a few different parts of healthcare and walk through how they work with diagrams, case studies, and memes. Lightweight assignments and quizzes afterward will help solidify the material and prompt discussion in the student Slack group.

.png)

Healthcare 101 Starts soon!!

See All Courses →Our crash course teaches the basics of US healthcare in a simple to understand and fun way. Understand who the different stakeholders are, how money flows, and trends shaping the industry.Each day we’ll tackle a few different parts of healthcare and walk through how they work with diagrams, case studies, and memes. Lightweight assignments and quizzes afterward will help solidify the material and prompt discussion in the student Slack group.

.png)

Healthcare 101 starts soon!!

See All Courses →Our crash course teaches the basics of US healthcare in a simple to understand and fun way. Understand who the different stakeholders are, how money flows, and trends shaping the industry.Each day we’ll tackle a few different parts of healthcare and walk through how they work with diagrams, case studies, and memes. Lightweight assignments and quizzes afterward will help solidify the material and prompt discussion in the student Slack group.

.png)

Healthcare 101 starts soon!

See All Courses →Our crash course teaches the basics of US healthcare in a simple to understand and fun way. Understand who the different stakeholders are, how money flows, and trends shaping the industry.Each day we’ll tackle a few different parts of healthcare and walk through how they work with diagrams, case studies, and memes. Lightweight assignments and quizzes afterward will help solidify the material and prompt discussion in the student Slack group.

.png)

Interlude - Our 3 Events + LLMs in healthcare

See All Courses →We have 3 events this fall.

Data Camp sponsorships are already sold out! We have room for a handful of sponsors for our B2B Hackathon & for our OPS Conference both of which already have a full house of attendees.

If you want to connect with a packed, engaged healthcare audience, email sales@outofpocket.health for more details.