The Ro Breakdown

Get Out-Of-Pocket in your email

Looking to hire the best talent in healthcare? Check out the OOP Talent Collective - where vetted candidates are looking for their next gig. Learn more here or check it out yourself.

Hire from the Out-Of-Pocket talent collective

Hire from the Out-Of-Pocket talent collectiveIntro to Revenue Cycle Management: Fundamentals for Digital Health

Network Effects: Interoperability 101

.gif)

Featured Jobs

Finance Associate - Spark Advisors

- Spark Advisors helps seniors enroll in Medicare and understand their benefits by monitoring coverage, figuring out the right benefits, and deal with insurance issues. They're hiring a finance associate.

- firsthand is building technology and services to dramatically change the lives of those with serious mental illness who have fallen through the gaps in the safety net. They are hiring a data engineer to build first of its kind infrastructure to empower their peer-led care team.

- J2 Health brings together best in class data and purpose built software to enable healthcare organizations to optimize provider network performance. They're hiring a data scientist.

Looking for a job in health tech? Check out the other awesome healthcare jobs on the job board + give your preferences to get alerted to new postings.

TL:DR

Ro is building a direct-to-patient healthcare company that combines pharmacy, telemedicine, labs, and more. They focus on providing a better patient experience and straightforward pricing for many different health areas including metabolic health, sexual health, hair, skin, and more. As the company grows, there will be questions around how they hand off into the traditional healthcare system, the limits to patient centrism, and the encroachment of competition. We also talk about the economic questions around incentives for prescribing, point solutions in healthcare, and the place of asynchronous telemedicine.

***This is a sponsored post - you can read more about my rules/thoughts on sponsored posts here. If you’re interested in having a sponsored post done, email nikhil@outofpocket.health.

Company Name - Ro

Ro is focused on delivering direct-to-patient healthcare. The company was originally called Roman and focused on erectile dysfunction, but rebranded to Ro when they expanded past just men’s health. I assume they were able to keep the tagline “it’s all up and to the right”.

The company was founded by Zachariah Reitano, Saman Rahmanian, and Rob Schutz. They’ve so far raised just over $1B from firms including General Catalyst, FirstMark Capital, ShawSpring Partners, TQ Ventures and 776.

This is going to be an interesting post to write without tripping off the many spam filters looking out for s-e-x words. The “hot singles in your area” people really ruined things for the rest of us.

What does the company do?

In their words, Ro wants to build “goal-oriented healthcare”. A patient comes to them with some specific health goal like “I want to fix my skin”, “I want to have a child”, or “I’m worried I’m losing my girlfriend to Jason Momoa because of his thick hair”. The current system is designed around care settings, specialties, or outcomes based on metrics at a population health level vs. an individual. We’ve talked about how there’s a lot of individual-level variability in health goals which traditional outcome measures don’t reflect.

At its core, Ro provides care, medications, and labs for several different areas of healthcare.

The component pieces that Ro has built in-house or acquired are:

- Full-time, salaried clinicians on the Ro platform + pharmacists and non-clinical support. 70% of Ro’s provider network is made up of full-time, salaried providers and about 70% of all Ro patients are seen by a full-time provider.

- 12 in-house pharmacies distributed throughout the country for next day meds and compounding needs. Their mail-order pharmacy has 1000+ generic drugs and 6 to 12 month refills for cash pay patients.

- Ability to send customizable, at-home diagnostic testing kits to a patient. These kits include capabilities for finger prick blood assays, blood pressure tests, weight measurement tools, saliva and more.

- Their own CLIA certified/CAP accredited lab via their acquisition of Kit. It’s my personal favorite because some of the tests include a cute lil’ centrifuge for you to use at home.

With all of this in-house, you can use different permutations to address different health issues that patients have. Ro’s approach to “goal oriented healthcare” is an evolution of building its products in a “jobs to be done” fashion - patient has a problem, Ro uses this stack to figure out the right permutation.

The pieces above are meant to be able to tackle whatever that individual patient’s goal is in one place. They currently have offerings tackling these goals in:

- Sexual Health - Generic drugs, wipes, over-the-counter treatments for genital herpes, erectile dysfunction, vaginal dryness, and more.

- Hair/Skin - Custom and prescription topicals for skin care/eczema. Prescription antiperspirant for excessive sweating. Generic latisse for eyelash length. Minoxidil/finasteride + custom formulations/supplements for hair growth.

- Daily Health - Vitamins and supplements for everyday health. Testosterone support, testing and treatment. Treatments for allergies, hot flashes, and more.

- Fertility - Through the acquisitions of Modern Fertility and Dadi, Ro offers hormone tests, prenatal vitamins, ovulation tests, pregnancy tests and sperm testing and storage. They have some good posts on what information from these tests can and can’t do.

- Weight Management – Ro has a direct relationship with Gelesis to be the only online provider of Plenity, an FDA-cleared weight management aid. Patients can also access a program for GLP-1s which includes at-home diagnostics. They also send a bluetooth-enabled scale that directly connects data from patients to their EHR, so they can make adjustments as necessary.

- Mental Health - Provider check-ins, treatment plans, prescription medication (if needed), and interactive, self-guided virtual sessions to help manage anxiety and depression.

For most of these journeys a patient will:

- Fill out a patient intake flow for an assessment that asks questions about your medication history, issues with your health, flag potential ancillary issues that might be related, etc. The flow changes depending on how you answer the questions.

- A physician reviews it on their own time, which allows them to “see” many more patients in a given hour. The erectile dysfunction conversation is already awkward enough, we don’t need to add on minutes to ask about how my job is going.

- A face-to-face with a doctor if necessary or the patient asks for it. Certain states and conditions will require this.

- Have a kit sent for home collection to be sent to a lab if necessary to confirm a diagnosis or monitor patients.

- A prescription is written if necessary and sent to one of Ro’s pharmacies or a pharmacy of your choosing if you want to get it yourself.

- Follow-up asynchronous check-in to make adjustments as necessary or get questions answered.

- All of this passes through Ro’s electronic health record that’s built in-house and customized for these different care pathways + data streams.

Below are some examples of what a patient journey might actually look like via Ro.

ED Treatment + Diagnostic Test: A patient experiencing ED can get symptomatic care through Ro via diagnosis + delivery (e.g. generic viagra) – Ro will send patients a blood pressure cuff if they don’t know their blood pressure. Patients can also do an at-home blood test to help uncover the underlying cause of their ED. Ro will send a finger prick blood sample testing kit that allows patients to screen for underlying causes (ex. blood sugar, cholesterol) from home (via Kit). Patients send the sample to Ro’s lab and receive their results online or in the Ro app.

Modern Fertility & Ro Sperm Kit: Patients seeking fertility testing services can access a hormone testing kit via Modern Fertility and sperm kit via Ro Sperm Kit — both sent to a patient’s home to collect appropriate samples for lab testing. The “reading material” for this is better at home anyway, such as the blog Out-Of-Pocket.

Customized Skin Care – Patients complete an online visit highlighting their skincare goals. Based on goals + provider expertise, a personalized prescription skincare cream is made at Ro’s pharmacy and shipped within a few days. I told them “I want skin Leatherface would hunt me for”, which definitely put me on the bad list.

Putting it all together, you have a company trying to build as much non-hospital level or procedural care as possible.

.gif)

What is the business model and who is the end user?

Finally, an easy one. Usually with these posts I need the founder to slowly repeat sentences three times, record an explanation for me to listen to while I sleep, and show me a picture of a physical handshake between their sales team and customer before I understand what their business model is.

.gif)

This is much easier. Patients pay directly! You are the end user! Tears are streaming down my face with the straightforwardness. There’s even a pricing page that’ll tell you what you’ll pay. Compare that to these other pages from providers which show you how much you’ll pay.

For the health assessments, they’re usually free if you don’t see a provider face-to-face. For diagnostic tests they range from $69 to $99, and pharmacy products tend to range anywhere from $9 to $90.

Ro wants patients to “pay directly” which means making decisions in their care plan and then also controlling where the flow of money goes. They started with patients paying cash, but they’re branching into other areas where the employer/insurer/government is footing the bill but patients choose where those dollars go.

For example, in reference-based pricing a patient is given a lump sum for some procedure and gets to keep the difference if it’s below that amount or pay extra if it’s above. The patient is still directing the dollars but isn’t paying themselves. As more models evolve which let the patient still be the user and director of funds, Ro is aiming to become a viable place of care for those patients.

What pain points do they solve?

This might be a shocker to you but…the US healthcare system is not built with patient experience at the forefront. If that is actually a shocker to you, I assume you are in charge of the DMV.

One of the core reasons for the shitty experience is healthcare’s principal-agent problem that we talk about consistently in this newsletter. Patients are almost never the ones paying in US healthcare - it’s usually their employer, their insurer, etc.

But what would it look like if the patient was actually the one choosing AND paying? In e-commerce land, these brands are fighting to keep you as a customer. The number of brands that tell me they love me or send me messages over the holidays to stay cheerful is stratospheric. I’m pretty sure Aesop would physically fight someone on my behalf if I asked nicely and bought another body wash.

In contrast, most healthcare companies tell me to go f*** myself if I ask for anything, and won’t even tell me THAT unless I pay the copay. This is because most healthcare companies aren’t competing for your dollars - they’re competing for the attention of your health insurer (e.g. so they can get in-network), your employer (e.g. to use them to save cost), the hospital (e.g. to increase the revenue per patient), etc.

Ro is making the bet that if they cater to patients first, they can aggregate enough leverage of patients to force the other entities to be more patient-centric as well. And that their technology + component pieces can maintain that experience as it scales.

Job openings

Senior Manager, Supply Planning

Senior Product Manager, Commerce Platform

Staff Product Manager, Ro Fertility

See the full list of open roles on Ro’s careers page.

___

The questions on your mind

IMO Ro is a good litmus test for how you think about direct-to-patient digital health companies as a whole. There’s a few ideological questions that come up when thinking about a company like this which I’m sure are on all of your minds, so I made sure to ask.

If a company like this makes money on the pharmacy side, what guardrails prevent overprescribing? Ro said this is why they used salaried physicians and don’t give them bonuses on the number of prescriptions written, but give bonuses on patient satisfaction surveys and standardized clinical outcomes. They also said this is why they have multiple products and revenue streams per condition area, so they aren’t beholden to making money on any singular product in a care regimen. And finally, they said they’re trying to build trust with patients so those patients come back when they have other issues later. Ro thinks if they’re able to help patients with one healthcare goal, patients will come back the next time Ro can help. There’s still a reasonable argument to be made that if patients expect medication, their satisfaction surveys will reflect poorly if they don’t get it. Ro says this is why a big component of their patient surveys are around the patient’s “life goals” and whether they hit them or not, vs. the specific treatment used to get there.

I thought their CEO also had an interesting point about the fact that direct-to-patient companies inherently have much more scrutiny because they’re so visible to the public + journalists. The stimulant market basically saw scrutiny within 2 years vs. the opioid epidemic which was lurking in the background for decades and was much harder to pinpoint because of how much was caused by system wide failures that were happening in the back rooms. In a previous post I talked about how patients can act as a decentralized form of auditing of bad actors, and I guess this is an example of that in action.

Is this just creating more point solutions that further fragments care? Everyone is always justifiably worried that we keep creating more silos in healthcare. Ro believes that patients will engage with the healthcare system for a specific health goal in mind, but that can be a way to further engage them in other health goals which they aren’t yet thinking about. Their belief is it’s easier to have that whole health conversation after you start with one problem. Plus, you can build very different workflows per condition area that use different telemedicine modalities, pharmacy workflows, etc. vs. trying to force every patient to the same visit type.

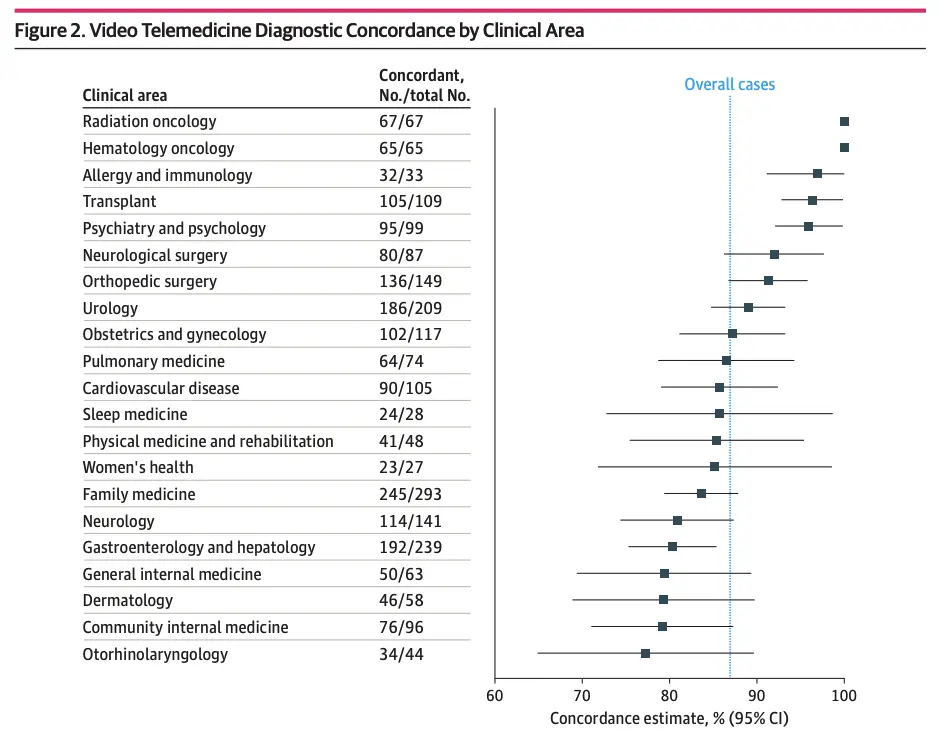

Will telemedicine miss things? When companies started using telemedicine there were a lot of questions about whether it was a worse form of care. This was especially true of asynchronous telemedicine where there wasn’t a face-to-face interaction. As we pore over the data around telemedicine use from COVID, the data seems to show that there’s a pretty high level of concordance between telemedicine and in-person diagnoses depending on the area of specialty and the issue. Non-physicians seem to be equally as consistent in-person vs. telemedicine too, which is good news for companies using care teams consisting of other clinicians.

Ro themselves have been doing some retrospective studies on their own patient population to understand how asynchronous and synchronous care match up, whether patients have more or less reported side effects based on the care modality, etc. Their general ethos is that with more patient touchpoints and patient reported outcomes, the more likely you can adjust care regimens or flag issues.

Another point worth considering too is whether doctors miss things in a traditional visit since they only have 15-20 minutes per patient and a chunk of it is spent asking patients questions they could fill out using async telemedicine. Using a combination of asynchronous and face-to-face visits, the patient can fill out the background information themselves and then the visit can be spent on the more complex questions.

Out-Of-Pocket Take

For long time readers of the newsletter it shouldn’t surprise you that I’m a fan of companies betting on patient experience as a whole. Here are some of the things I like about Ro.

Full stack approach - There are some things in healthcare that are commodities, and some things where there’s a high variance in the quality of services/goods. A generic drug should be the same regardless of the pharmacy you get it. A lab test should be the same at any CLIA-certified non-Theranos lab. A blood pressure cuff should be basically the same between brands. Compare that to something like brain surgery, where the variance can be high and the physician/facility you get the procedure matters a lot.

Ro is trying to bring those commodity infrastructure pieces in-house. The upfront cost is higher to set up, but this lets them capture more margin per unit of medication dispensed, lab test run, etc. The company can use that to re-invest in other things or lower costs. On top of that, it’s a better patient experience to have everything in one place because you can do quality control and process improvements much more easily when it’s in-house vs. trying to get a third-party to do it better.

I’m curious how far Ro chooses to push into “commodity” healthcare (e.g. what about imaging?), and simultaneously how things go for the less commoditized areas like mental health services which the company already operates.

Bottom-up adoption + new payment models - When I started reading and writing about healthcare in 2015, I was explicitly told that patients will never pay for anything out-of-pocket. Ro (and several other companies) have proved that the demand for cash pay services and medications outside of insurance does in fact exist if you have a good patient experience.

By starting in the cash market and targeting patients directly, they could build a lot of tools/workflows that wouldn’t make sense if they started with traditional insurance contracting first:

- You pay at the point of care and that’s it, no more waiting several months wondering whether you’re paying $5 or going to end up an NPR story about how medical debt ruined your life.

- The Modern Fertility Hormone Test that Ro offers for $179 via cashpay would typically be $600-$1000 via the insurance route and isn’t covered by insurance unless you’ve been unsuccessfully trying to conceive for over a year. Ro lets people skip that step and get access to the information they want sooner.

- Being able to message random questions to your care team instead of needing to make an appointment every time is nice. It feels like texting a doctor friend about stuff without explaining to them you have erectile dysfunction and potentially permanently changing your relationship with them. Now the big health systems are starting to charge for MyChart messaging, which is really peak fee-for-service and shows how divergent the patient experience <> reimbursement gap is becoming.

I’m interested to see if they can use their aggregated patient demand to force the legacy healthcare system into more patient-friendly contracting that allows them to keep these workflows and clear pricing, especially as they move into traditional health insurance coverage. Contracting is an absolute mess in the US - coming to the table with a lot of patients already on your platform can give you more leverage.

We’re already seeing them experiment in other areas that have struggled with patient engagement - for example they’re working with the National Institute on Aging to get more participants for an Alzheimer’s registry and clinical trial recruitment. I’m excited to see them try and push the patient experience thinking on more legacy areas of healthcare.

Land and expand - Many conditions you might go to Ro for are health goals you can identify yourself (e.g. if you have thinning hair). Those conditions might motivate people to go to the site, but Ro can use that interaction to learn more about the patient and guide them to other health improvement areas that are less noticeable or potentially interrelated. For example, if you're motivated to address your erectile dysfunction, you might go to Ro because they offer generic treatments for it, but it can also be an opening for a conversation around weight management and depression. Ro’s bet is also that patients will have such a positive experience with Ro they’ll come back for other conditions in the future, which is a fun 10 year bet that’s a bit too early to judge just yet.

—

The bet on a direct-to-patient healthcare company is still a big one with some uncertainties. Here are some of the things I wonder when thinking about the future of Ro.

Competition - Ro is betting that its brand, usability, and convenience will attract and retain patients. However, they do face competition from other brands, pharmacies, and traditional healthcare providers who are all trying to enter the space now and some of which have built-in distribution already. Plus that customer acquisition cost is absolutely brutal nowadays! Ro may have been one of the earlier players in this space, but now it’s become increasingly easier to start a direct-to-patient company.

The online-offline handoff - Ro is not meant to be a replacement for primary care, and views themselves as a complement to your existing primary care which I 100% absolutely definitely have. Today Ro targets health goals that are relatively easy for patients to self identify + there’s a clear medication and treatment regimen for. But when patients need to get things done in-person, Ro needs to have a clear way for patients to transition from the parallel healthcare ecosystem Ro is building to the in-person traditional one with all their data, historical medications, physician recommendations, etc. Ro is partnering with Ribbon, a provider information company, to make it easy to find IRL providers in different specialty areas, within your insurance coverage, filtered by quality, etc.

Limits to patient-centrism - I think there’s a bit of an ideological debate around whether it’s possible to actually present patients with information that is both understandable to the average patient and also nuanced enough for them to understand the risks, etc. Considering how complicated new drugs, tests, etc. are becoming it’s even hard for doctors to keep up and fully understand it themselves. If a patient is presented with information from lab values, hormone tests, etc. do we feel like they can interpret and feel confident in choosing their next steps of care?

I generally err to the side of patient’s should get more information than less and might actually lead to reinforcing a relationship with your clinician if you feel armed with data and assessing potential next steps. I think reasonable people could take either side.

Conclusion

Doing research for this piece has likely ruined my ad targeting for the next year, but here we are. I think Ro is running a great experiment. How large can a direct-to-patient business be? How many patients does it take to have leverage with payers? How many patients start with a short-term health goal and convert into a long-term health goal with a longitudinal PCP relationship?

In an ideal world, I’d love to see new payers/providers figure out more novel means of contracting that allow patients to still be the purchasers of healthcare goods and services while giving protections for high cost issues and assistance for those who can’t afford it. Maybe Ro is a first step in this direction. If healthcare were as straightforward as a Ro interaction then patients would probably be less distrustful and unhappy with their healthcare experience.

Thinkboi out,

Nikhil aka. “Ni”

Twitter: @nikillinit

Other posts: outofpocket.health/posts

{{sub-form}}

---

If you’re enjoying the newsletter, do me a solid and shoot this over to a friend or healthcare slack channel and tell them to sign up. The line between unemployment and founder of a startup is traction and whether your parents believe you have a job.

INTERLUDE - FEW COURSES STARTING VERY SOON!!

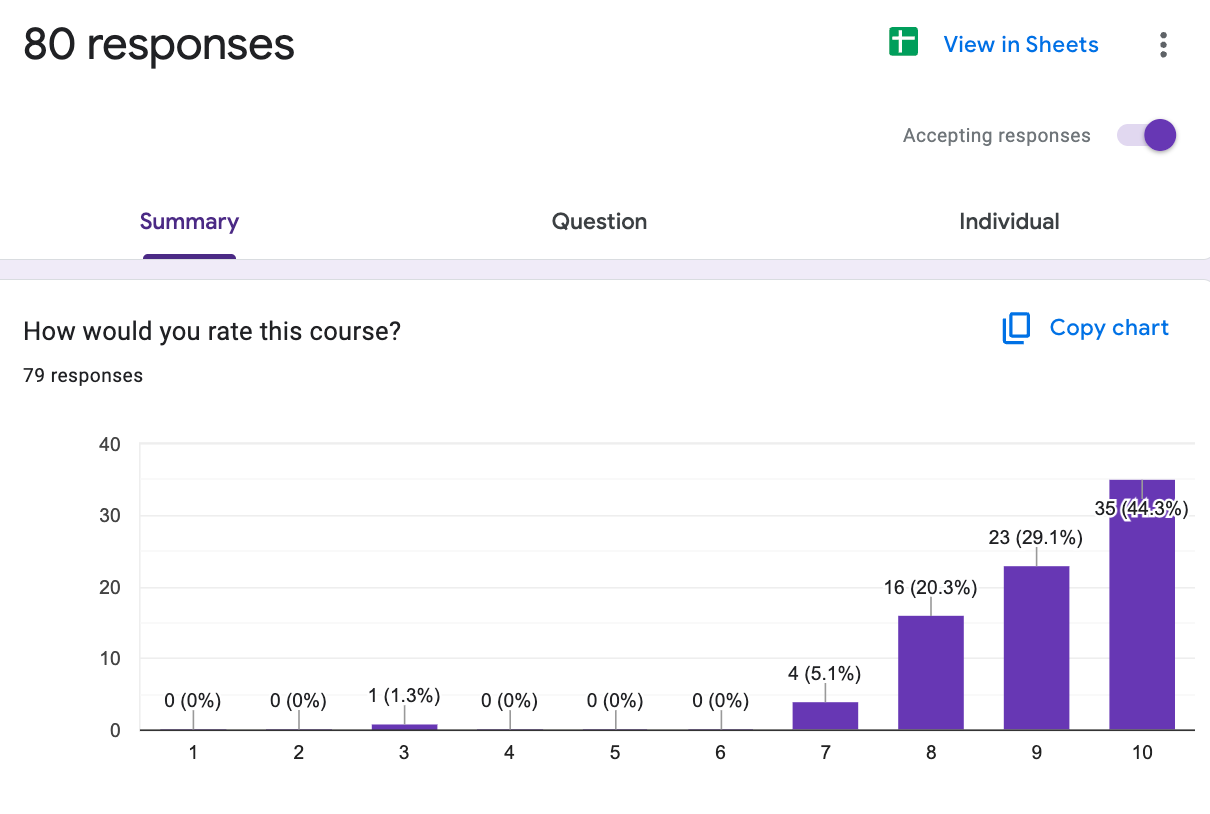

See All Courses →A reminder that there’s a few courses STARTING VERY SOON!!

LLMs in healthcare (starts 9/8) - We break down the basics of Large Language Models like chatGPT, talk about what they can and can’t do in healthcare, and go through some real-world examples + prototyping exercises.

Healthcare 101 (starts 9/22) - I’ll teach you and your team how healthcare works. How everyone makes money, the big laws to know, trends affecting payers/pharma/etc.

We’ll do group rates, custom workshops, etc. - email sales@outofpocket.health and we’ll send you details.

INTERLUDE - FEW COURSES STARTING VERY SOON!!

See All Courses →A reminder that there’s a few courses STARTING VERY SOON!! And it’s the final run for all of them (except healthcare 101).

LLMs in healthcare (starts 9/8) - We break down the basics of Large Language Models like chatGPT, talk about what they can and can’t do in healthcare, and go through some real-world examples + prototyping exercises.

Healthcare 101 (starts 9/22) - I’ll teach you and your team how healthcare works. How everyone makes money, the big laws to know, trends affecting payers/pharma/etc.

How to contract with Payers (starts 9/22) - We’ll teach you how to get in-network with payers, how to negotiate your rates, figure out your market, etc.

We’ll do group rates, custom workshops, etc. - email sales@outofpocket.health and we’ll send you details.

INTERLUDE - FEW COURSES STARTING VERY SOON!!

See All Courses →A reminder that there’s a few courses STARTING VERY SOON!! And it’s the final run for all of them (except healthcare 101).

LLMs in healthcare (starts 9/8) - We break down the basics of Large Language Models like chatGPT, talk about what they can and can’t do in healthcare, and go through some real-world examples + prototyping exercises.

Healthcare 101 (starts 9/22) - I’ll teach you and your team how healthcare works. How everyone makes money, the big laws to know, trends affecting payers/pharma/etc.

How to contract with Payers (starts 9/22) - We’ll teach you how to get in-network with payers, how to negotiate your rates, figure out your market, etc.

Selling to Health Systems (starts 10/6) - Hopefully this post explained the perils of selling point solutions to hospitals. We’ll teach you how to sell to hospitals the right way.

EHR Data 101 (starts 10/14) - Hands on, practical introduction to working with data from electronic health record (EHR) systems, analyzing it, speaking caringly to it, etc.

We’ll do group rates, custom workshops, etc. - email sales@outofpocket.health and we’ll send you details.

INTERLUDE - FEW COURSES STARTING VERY SOON!!

See All Courses →Our Healthcare 101 Learning Summit is in NY 1/29 - 1/30. If you or your team needs to get up to speed on healthcare quickly, you should come to this. We'll teach you everything you need to know about the different players in healthcare, how they make money, rules they need to abide by, etc.

Sign up closes on 1/21!!!

We’ll do group rates, custom workshops, etc. - email sales@outofpocket.health and we’ll send you details.

Interlude - Our 3 Events + LLMs in healthcare

See All Courses →We have 3 events this fall.

Data Camp sponsorships are already sold out! We have room for a handful of sponsors for our B2B Hackathon & for our OPS Conference both of which already have a full house of attendees.

If you want to connect with a packed, engaged healthcare audience, email sales@outofpocket.health for more details.