First Dollar and the HSA wedge

Get Out-Of-Pocket in your email

Looking to hire the best talent in healthcare? Check out the OOP Talent Collective - where vetted candidates are looking for their next gig. Learn more here or check it out yourself.

Hire from the Out-Of-Pocket talent collective

Hire from the Out-Of-Pocket talent collectiveIntro to Revenue Cycle Management: Fundamentals for Digital Health

Network Effects: Interoperability 101

.gif)

Featured Jobs

Finance Associate - Spark Advisors

- Spark Advisors helps seniors enroll in Medicare and understand their benefits by monitoring coverage, figuring out the right benefits, and deal with insurance issues. They're hiring a finance associate.

- firsthand is building technology and services to dramatically change the lives of those with serious mental illness who have fallen through the gaps in the safety net. They are hiring a data engineer to build first of its kind infrastructure to empower their peer-led care team.

- J2 Health brings together best in class data and purpose built software to enable healthcare organizations to optimize provider network performance. They're hiring a data scientist.

Looking for a job in health tech? Check out the other awesome healthcare jobs on the job board + give your preferences to get alerted to new postings.

TL:DR First Dollar is a new Health Savings Account (HSA) that makes it easier for you to take advantage of the HSA tax benefits while charging consumers less fees. While the company will face education and distribution challenges, owning the HSA relationship has a lot of potential upside benefits.

This is a great time to explain how HSAs work, who First Dollar is + the bets they’re making, and some of my thoughts.

This is a sponsored post - you can read more about my rules/thoughts on sponsored posts here.

Company Name

First Dollar - a new Health Savings Account (HSA) that’s raised $5M in venture funding, headquartered in Austin, Texas, and co-founded by Jason Bornhorst and Colin Anawaty.

What does the company do and what pain point does this solve?

Let me start by giving a bit of background on HSAs. Right now if you buy a high deductible health plan, it will usually come with an HSA that you can put money in to spend on future healthcare expenses through a debit card looking thing. That money isn’t just sitting there - you can invest in stocks, ETFs, mutual funds, etc. when you’re not using it so that it can grow over time.

HSAs are an extremely dope place to store money, because it’s triple-tax advantaged.

Tax advantage 1: You can put money into it tax-free

Tax advantage 2: The money grows in the HSA account tax-free

Tax advantage 3: If you use the HSA for qualified medical expenses, it uses tax-free dollars. That includes medicated chapstick btw, in case you needed some.

If you assume that at some point in your life you’ll eventually spend money on healthcare (which, uh, doesn’t seem to be changing anytime soon), then this is the most tax-friendly place to put your money. And even if you don’t use it on healthcare, you still get tax advantages #1 and #2. If you’re a consumer, there really isn’t a reason you shouldn’t be maxing out your HSA contributions each year if you’re able. Trust me I read this on r/personalfinance.

Also a fun fact - HSAs are one of the few things you can actually bring with you from one insurance plan to another. You all probably know how I feel about the fact that every time you switch jobs you’re forced to switch insurance plans and the strange dynamics it creates. You can actually use the same HSA if you change jobs, you just tell your employer that you want to contribute there (and they basically have to). So if you really like an HSA, you can choose to keep putting money into it when you change jobs.

Even with all that though, the number of people that contribute to an HSA has been pretty low. There are lots of different theories why: consumer knowledge of HSA benefits isn’t great, poor user experience prevents people from signing/setting it up, the fees that HSAs charge to keep and manage your money, more immediate cash needs that prevent saving, and more.

This is where First Dollar is making a bet. The three core differentiators the company is pitching as an HSA is:

- Better user experience - it takes about 3 minutes to onboard and then a partnership with TD Ameritrade makes it easy for users to take that money and invest it wherever they want (stocks, ETFs, etc.).

- Different fee structure - First Dollar doesn’t charge users fees for maintaining or investing the HSA dollars.

- Negotiated discounts - First Dollar has partners that provide cheaper, cash pay prices for things. So these wouldn’t count towards your deductible, but you can find cheaper cash pay consultations with a provider or cash pay generic drugs via their partnership with RxSaver. This is useful for minor/acute things if you think you won’t hit your deductible that year, but also for things your insurance may not cover like mental health, women’s health, etc.

P.S. Another fun fact about HSAs since I’m chock full of them - they actually turn into an Individual Retirement Account (IRA) at age 65. So when you couple that with the triple-tax advantage it actually makes them even better than a 401k.

What is the business model and who is the end user?

Patients with high deductible plans are the end users of First Dollar. They either sign up directly on the site as individuals, or through their employer.

Since they’re not making money on fees charged to the consumer, how does First Dollar make money? Three main ways:

- Employer administration fees - If your employer wants to offer this to their employees, they gotta pay!

- Interest on HSA deposits - Since First Dollar has money from a bunch of customers, it starts generating interest for First Dollar.

- Card Network Fees (aka. Interchange Fees) - This is similar to how any debit or credit card works. Basically if you use your card at a store, the store’s bank will actually pay a small fee to the credit card for the privilege of accepting said card. First Dollar takes a portion of the fee.

Normal HSAs make money in all these ways as well, but also charge certain consumer fees on top of that to manage. No one likes double dippers.

What does the process look like if you're a customer/user?

If you have an HSA, you should compare the fees and investments vs. alternative HSAs. And if you haven’t been contributing to yours, you should DEFINITELY do that.

I encourage you to do your own research as well, but from a fees and usability perspective First Dollar seems solid.

A step-by-step process of what First Dollar looks like as an individual:

- First, you have to either have an existing HSA or be in a high deductible health plan.

- Users can apply for a First Dollar HSA in about 3 minutes. They’ll get debit cards for their family, and manage their account via their web app.

- Users then fund their HSA with pre-tax dollars in three ways:

- Link their bank account via Plaid and contribute directly.

- Redirect their employer contributions to First Dollar. This process is similar to splitting your paycheck across multiple accounts.

- Transfer their existing HSA balance to First Dollar, similar to a 401k rollover.

- Users can save their money in a cash account, or invest tax-free in different mutual funds, ETFs, or stocks. Now you can day-trade cruise line stocks, but with tax-benefit dollars instead!

- Users can spend on eligible healthcare expenses (tax-free!) by swiping their First Dollar debit card or reimbursing their linked bank account.

If your company is providing you with access to a First Dollar HSA, then steps 1-3 will happen automatically if you enroll in a high deductible health plan through your job. Depending on your work situation and how cool your boss is, your employer may also contribute to your HSA.

Job Openings

First Dollar is currently looking for Sales Executives to sell into employers.

If you’re interested, you can email sales@firstdollar.com. If you wanna be my friend and mention you saw it here, that would be swell (more just for my own tracking purposes).

Out-Of-Pocket Take

I’m a fan of HSAs, and I think they’re wildly underutilized as a savings vehicle because most people just think of them as “debit cards you fill up for in case you have a health issue”. It’s actually one of the things I’m sad about now that I’m in a catastrophic health insurance plan - I’m no longer eligible to have an HSA :(.

If a simpler user experience and more plain english explanations are able to get more customers to contribute, then I think First Dollar is onto something. I can’t claim to have loved using any of my HSAs.

If more consumers look to their HSA to guide them in making smart, cash pay choices below their deductible (similar to what GoodRx, etc. are doing), then being the HSA of choice has a lot of benefits. This is especially powerful because the HSA travels with you from health insurance plan to health insurance plan, so you can actually stay as a customer for a long time (that sweet, sweet LTV).

Some battles I think First Dollar will face:

- Education - How do you teach people about HSAs as a savings vehicle vs. just a healthcare one?

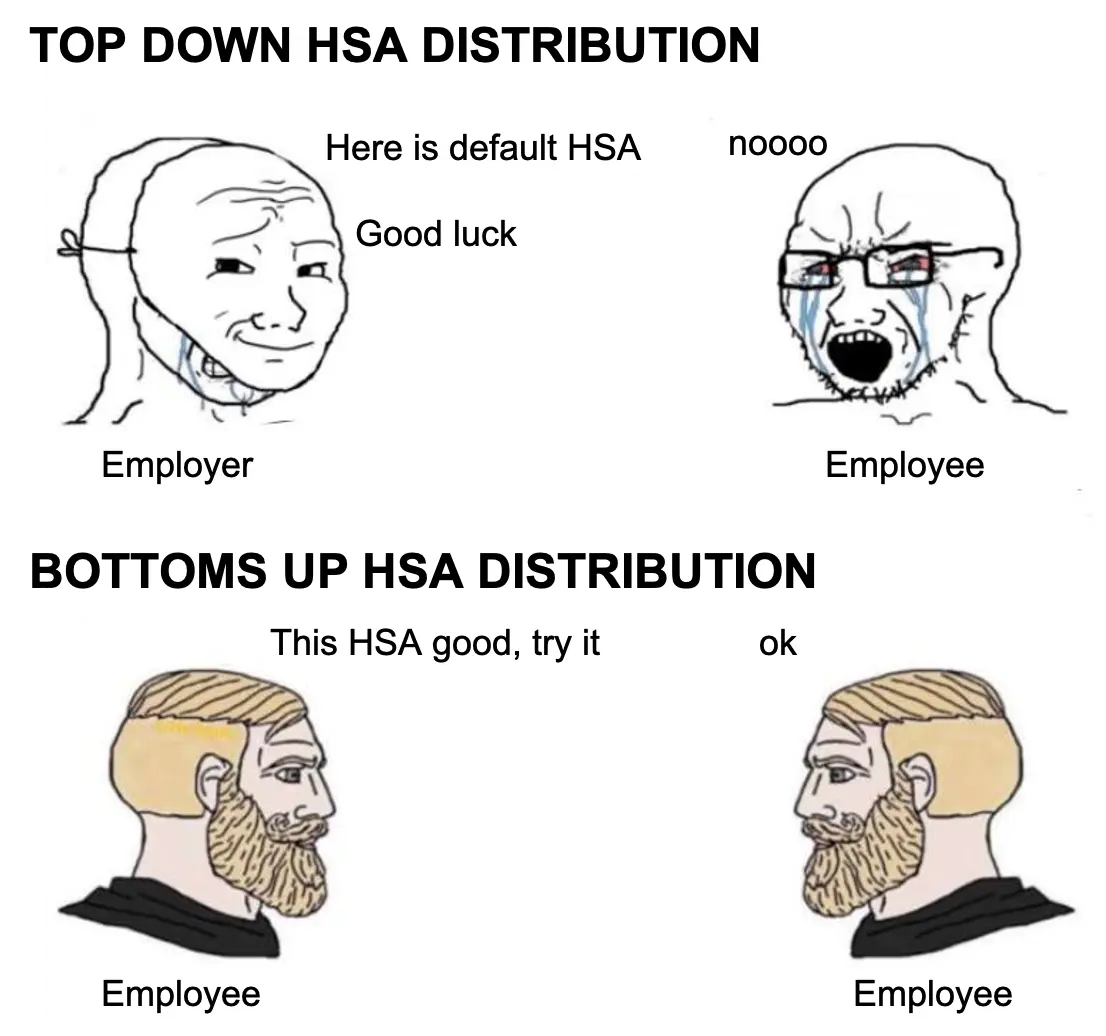

- Distribution - How do you compete with health insurance carriers that have their own HSAs which they push and most employers just default agree to? Is competing on fees and user experience enough?

- Competition - How defensible is user experience and fees from other new HSA entrants?

- Usage - How does First Dollar convince users to check out the deals they have for cash pay discounts instead of always defaulting to their insurance?

If First Dollar has a phenomenally better user experience than a traditional HSA, people will tell their friends to use it and it’ll get adoption by word-of-mouth. Or people can convince their employers to include it instead of picking what their insurance carrier offers (aka. get bottoms-up adoption from employees). If First Dollar can pull that off, it can more easily get into the hands of consumers and get distribution.

I’m interested to see how First Dollar addresses patient engagement. Everyone wants to be the front door to healthcare, but for most people HSAs are a “set it and forget it” action. First Dollar will have to figure out how to stay top of mind when a health purchase comes up for a patient. Or they’ll have to rely on some of their partners like RxSaver to remind patients to check the cash pay price vs. their insurance price to see what’s cheaper. These aren’t impossible challenges and I’ve written in the past about how some companies tackle patient engagement in the self-insured employer segment.

I’m excited about the company, and if you’re a consumer or employer thinking about offering a new HSA I definitely think First Dollar is worth checking out.

Thinkboi out,

Nikhil aka. “close to my Last Dollar”

Twitter: @nikillinit

INTERLUDE - FEW COURSES STARTING VERY SOON!!

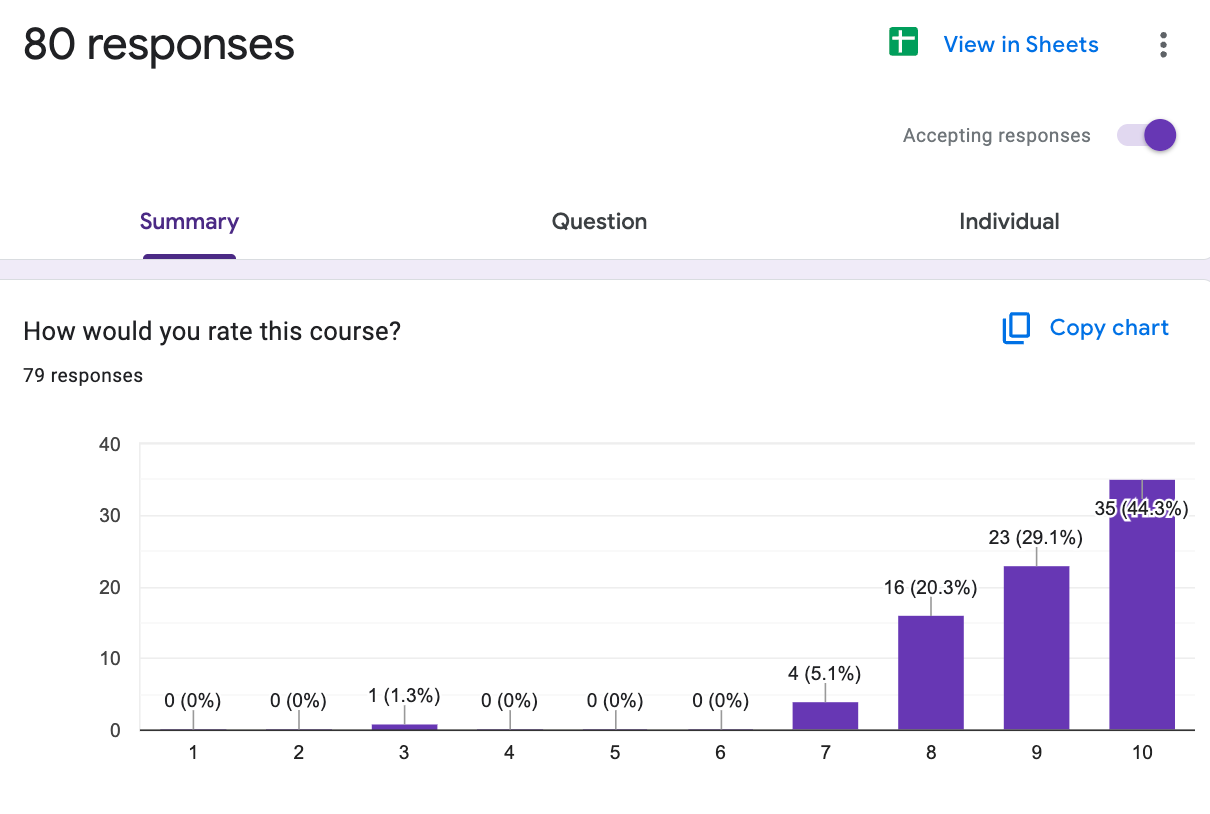

See All Courses →A reminder that there’s a few courses STARTING VERY SOON!!

LLMs in healthcare (starts 9/8) - We break down the basics of Large Language Models like chatGPT, talk about what they can and can’t do in healthcare, and go through some real-world examples + prototyping exercises.

Healthcare 101 (starts 9/22) - I’ll teach you and your team how healthcare works. How everyone makes money, the big laws to know, trends affecting payers/pharma/etc.

We’ll do group rates, custom workshops, etc. - email sales@outofpocket.health and we’ll send you details.

INTERLUDE - FEW COURSES STARTING VERY SOON!!

See All Courses →A reminder that there’s a few courses STARTING VERY SOON!! And it’s the final run for all of them (except healthcare 101).

LLMs in healthcare (starts 9/8) - We break down the basics of Large Language Models like chatGPT, talk about what they can and can’t do in healthcare, and go through some real-world examples + prototyping exercises.

Healthcare 101 (starts 9/22) - I’ll teach you and your team how healthcare works. How everyone makes money, the big laws to know, trends affecting payers/pharma/etc.

How to contract with Payers (starts 9/22) - We’ll teach you how to get in-network with payers, how to negotiate your rates, figure out your market, etc.

We’ll do group rates, custom workshops, etc. - email sales@outofpocket.health and we’ll send you details.

INTERLUDE - FEW COURSES STARTING VERY SOON!!

See All Courses →A reminder that there’s a few courses STARTING VERY SOON!! And it’s the final run for all of them (except healthcare 101).

LLMs in healthcare (starts 9/8) - We break down the basics of Large Language Models like chatGPT, talk about what they can and can’t do in healthcare, and go through some real-world examples + prototyping exercises.

Healthcare 101 (starts 9/22) - I’ll teach you and your team how healthcare works. How everyone makes money, the big laws to know, trends affecting payers/pharma/etc.

How to contract with Payers (starts 9/22) - We’ll teach you how to get in-network with payers, how to negotiate your rates, figure out your market, etc.

Selling to Health Systems (starts 10/6) - Hopefully this post explained the perils of selling point solutions to hospitals. We’ll teach you how to sell to hospitals the right way.

EHR Data 101 (starts 10/14) - Hands on, practical introduction to working with data from electronic health record (EHR) systems, analyzing it, speaking caringly to it, etc.

We’ll do group rates, custom workshops, etc. - email sales@outofpocket.health and we’ll send you details.

INTERLUDE - FEW COURSES STARTING VERY SOON!!

See All Courses →Our Healthcare 101 Learning Summit is in NY 1/29 - 1/30. If you or your team needs to get up to speed on healthcare quickly, you should come to this. We'll teach you everything you need to know about the different players in healthcare, how they make money, rules they need to abide by, etc.

Sign up closes on 1/21!!!

We’ll do group rates, custom workshops, etc. - email sales@outofpocket.health and we’ll send you details.

Interlude - Our 3 Events + LLMs in healthcare

See All Courses →We have 3 events this fall.

Data Camp sponsorships are already sold out! We have room for a handful of sponsors for our B2B Hackathon & for our OPS Conference both of which already have a full house of attendees.

If you want to connect with a packed, engaged healthcare audience, email sales@outofpocket.health for more details.